The following is an article from the Coldwell Banker St. Croix Realty April 2017 Newsletter:

It’s tax time. If you talk to real estate investors, many are doing 1031 Exchanges. A tax-deferment strategy, a 1031 Exchange allows sellers to postpone recognition of capital gains if they purchase a like-kind property (or properties—and “like-kind” doesn’t mean land for land or a condo for a condo. As long as it’s an investment property, it can work.) with profits from their sale. Rules apply, and sometimes the rules change.

It’s tax time. If you talk to real estate investors, many are doing 1031 Exchanges. A tax-deferment strategy, a 1031 Exchange allows sellers to postpone recognition of capital gains if they purchase a like-kind property (or properties—and “like-kind” doesn’t mean land for land or a condo for a condo. As long as it’s an investment property, it can work.) with profits from their sale. Rules apply, and sometimes the rules change.- A 1031 Exchange pertains to investment or business properties only.

- “Like-Kind” means you swap a property for another investment or business property. You may exchange a rental house for a commercial space.

- The purchase price and the loan amount on the new property must equal or surpass that of the replaced property.

- You must identify a like- kind property or properties within 45 days of your original closing.

- You must purchase the new property within 180 days of your closing.

- The title holder must match on both the old and new properties.

- The IRS permits partial 1031 Exchanges when the new property is of lesser value; you pay capital gains taxes on the difference.

The

The  Everyone has their own unique St. Croix story, though there’s usually a common theme of escaping the rat race on the mainland. Bob and Michele’s starts the same way, but is a fascinating near 20-year tale.

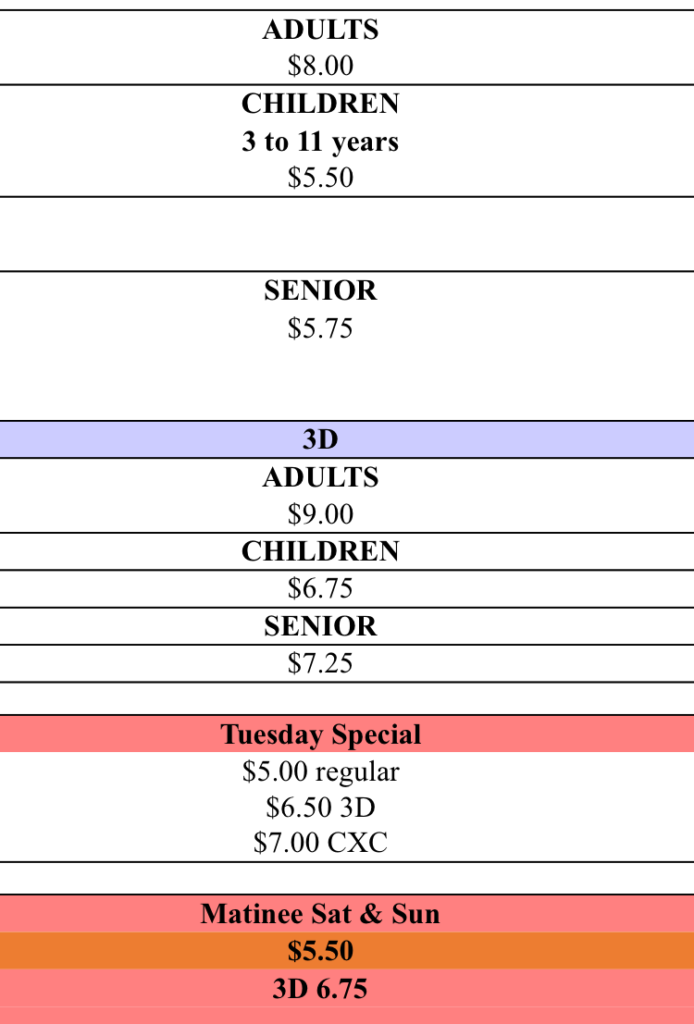

Everyone has their own unique St. Croix story, though there’s usually a common theme of escaping the rat race on the mainland. Bob and Michele’s starts the same way, but is a fascinating near 20-year tale. Roll out the red carpet! Caribbean Cinemas is opening their brand new, state-of-the-art cinema complex on Friday, March 10, in Sunny Isle. The new complex has eight screens with stadium seating, 100% digital projection, and high-definition surround sound. One of the cinema auditoriums will be a Premium Large Format Auditorium — CXC (Caribbean Cinemas Extreme) — which will create an immersive experience by providing a wall to wall and a ceiling to floor screen – almost four stories tall!

Roll out the red carpet! Caribbean Cinemas is opening their brand new, state-of-the-art cinema complex on Friday, March 10, in Sunny Isle. The new complex has eight screens with stadium seating, 100% digital projection, and high-definition surround sound. One of the cinema auditoriums will be a Premium Large Format Auditorium — CXC (Caribbean Cinemas Extreme) — which will create an immersive experience by providing a wall to wall and a ceiling to floor screen – almost four stories tall!

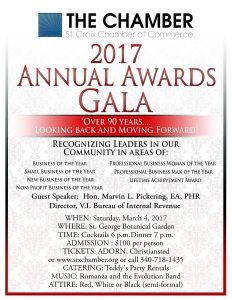

New Business of the Year 2016

New Business of the Year 2016 Twice voted Best Real Estate Broker on St. Croix. Coldwell Banker President's Circle three years in a row.

Twice voted Best Real Estate Broker on St. Croix. Coldwell Banker President's Circle three years in a row.